The Biden administration on Tuesday caved after enormous pushback from across the United States and the political spectrum. The Dems were proposing to allow the IRS to snoop on taxpayer’s bank transactions to make ‘billionaires pay their fair share.’

But when America saw they tried the bait and switch and were planning on letting the IRS snoop on transactions over $600, America said not a chance.

To tell you how badly they miscalculated this, the Dems are now and endorsing a different version of a proposal that while still bad is not as obscene as the original. Under a new plan, banks, credit unions and other financial institutions would be required to report on accounts with deposits and withdrawals worth more than $10,000, rather than the $600.

“Today’s new proposal reflects the administration’s strong belief that we should zero in on those at the top of the income scale who don’t pay the taxes they owe, while protecting American workers by setting the bank account threshold at $10,000 and providing an exemption for wage earners like teachers and firefighters,” Treasury Secretary Janet Yellen said.

From Fox Business:

Banks are already required to report any transaction that exceeds $10,000 to the Financial Crimes Enforcement Network – part of anti-money laundering requirements.

The tightening of the plan follows a steady lobbying campaign from banking groups and other industry organizations that warned the original proposal would increase compliance costs and add to the already existing burden the industry faces in turning over information to the government, while Republicans have slammed it as the worst type of government overreach.

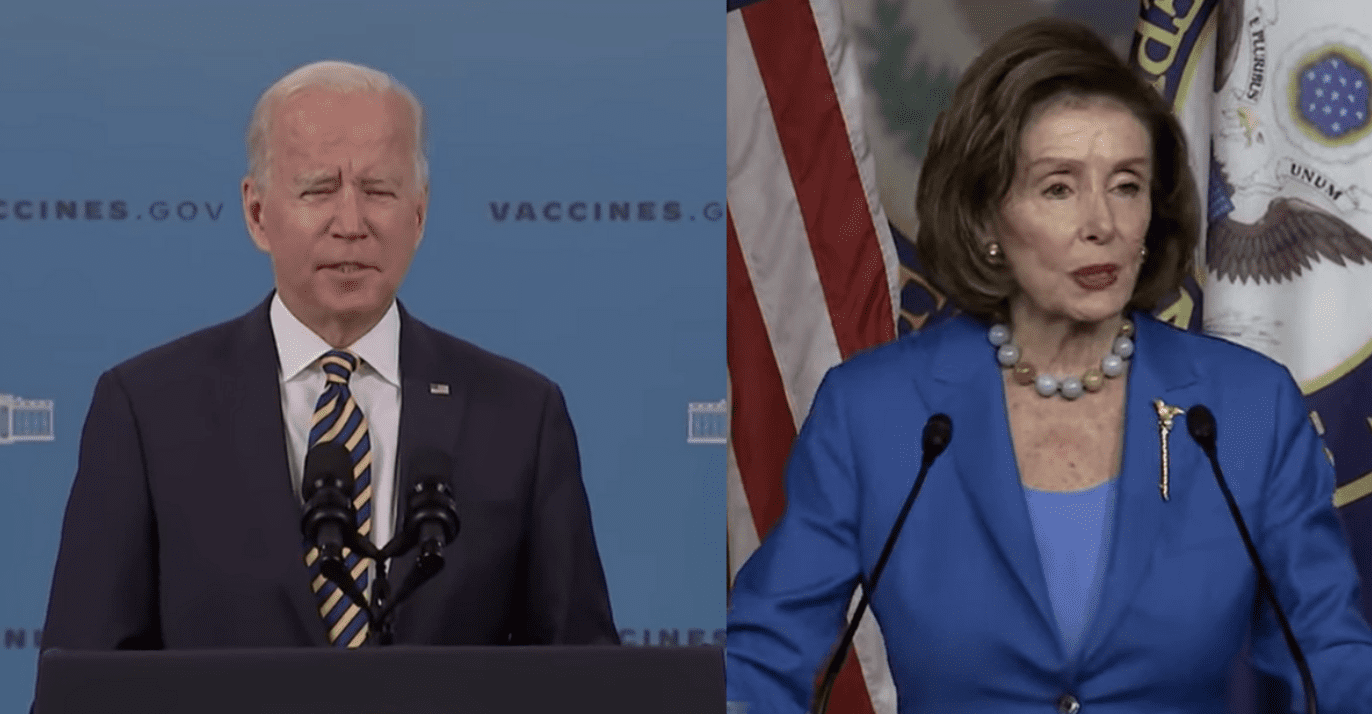

In a September letter addressed to House Speaker Nancy Pelosi, D-Calif., and Minority Leader Kevin McCarthy, R-Calif., more than 40 banks urged lawmakers to vote against such a proposal, warning it could create a “tremendous liability” for all involved by requiring the collection of financial information for the majority of Americans “without proper explanation of how the IRS will store, protect and use this enormous trove of personal financial information.”

“This proposal would create significant operational and reputational challenges for financial institutions, increase tax preparation costs for individuals and small businesses, and create serious financial privacy concerns,” they wrote.

“We urge members to oppose any efforts to advance this ill-advised new reporting regime.”

This plan will give the IRS the private banking data of seniors who have 401k retirement plans.

— Tom Cotton (@TomCottonAR) October 19, 2021

Americans don't want the IRS spying on them. https://t.co/d2IwO3nHWW

Democrats have altered their proposal after serious political backlash against a measure that would allow the IRS to track $600 bank account transactions. The number has now been increased to $10,000. https://t.co/pSGP52RkQM

— Daily Caller (@DailyCaller) October 19, 2021